0 ₺

450TL üzeri 1, 650 TL üzeri 2 Eklenti Hediye!

Sadece bize özel ürünler

Bu ürünleri kaçırma!

WEB TASARIM BLOĞUMDAN SON VİDEOLAR

Vaktim müsait oldukça aklıma gelenleri sizlerle paylaşmaya çalışıyorum. Hususi anlatmamı istediğiniz bir konu olduğunda lütfen bunu benimle paylaşınız. Bende öncelikli olarak hazırlayıp sizlere sunayım.

En Son Web Tasarım Eğitim Videolarım

Gerçek Müşteri Yorumları

Eğer %100 orijinal wp eklentisi arıyorsanız, ayrıca sizi bilgilendirecek ve yaşadığınız sorunlarda size güvenilir destek olacak birini arıyorsanız doğru adres webdeyeral olacaktır. R10 üzerinde wp plugini satmaya çalışan birçok kişiden daha çok faydasını gördüm. Umarım uzun yıllar boyu bu şekilde destek verir. Çok teşekkür ederim ilgi ve alakanıza 🙏

Eren Gelener – 12 Nisan 2024

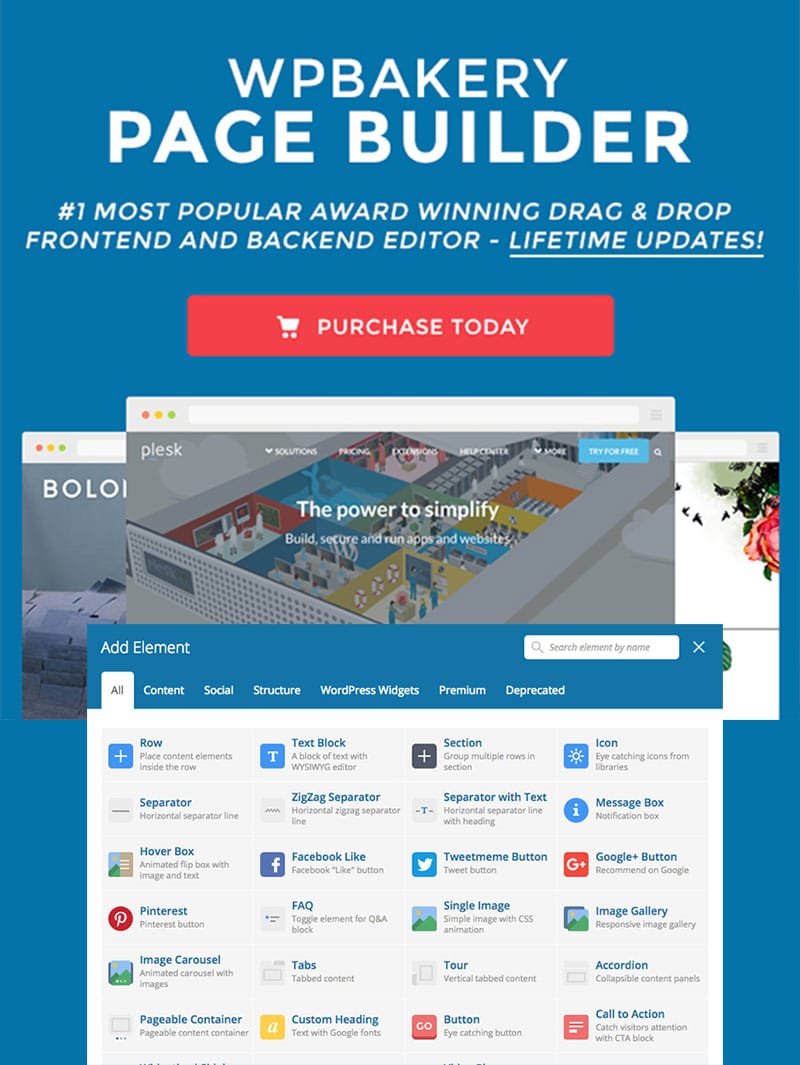

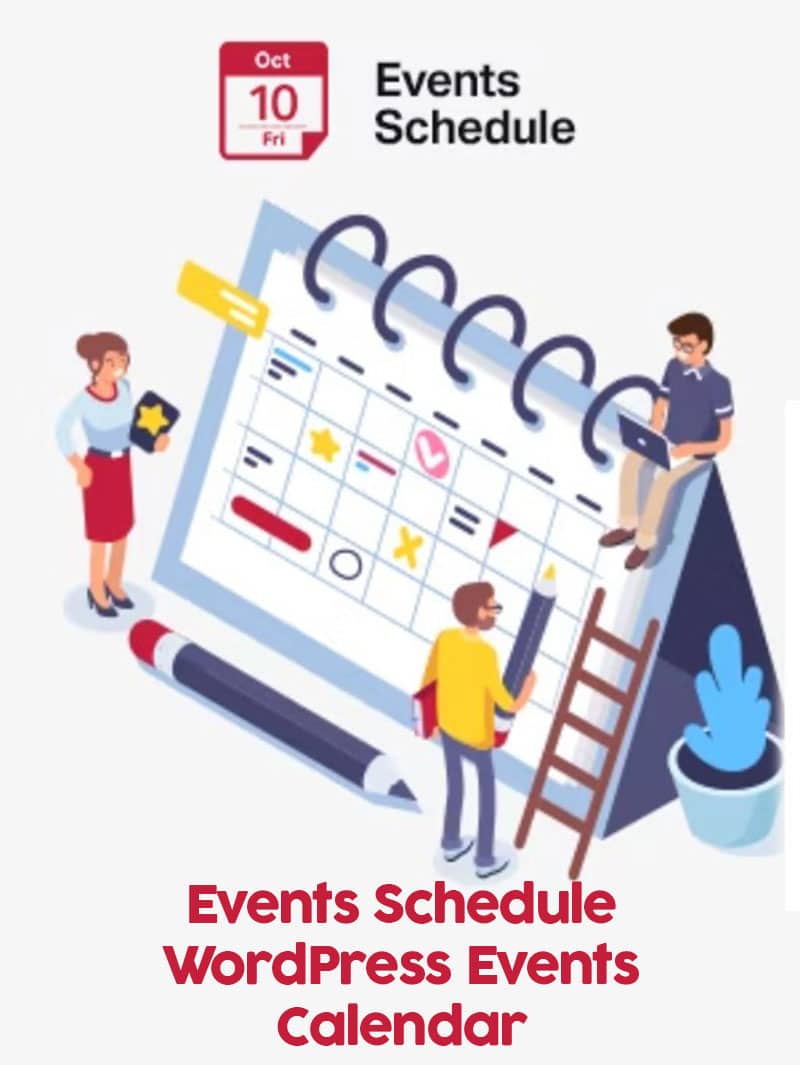

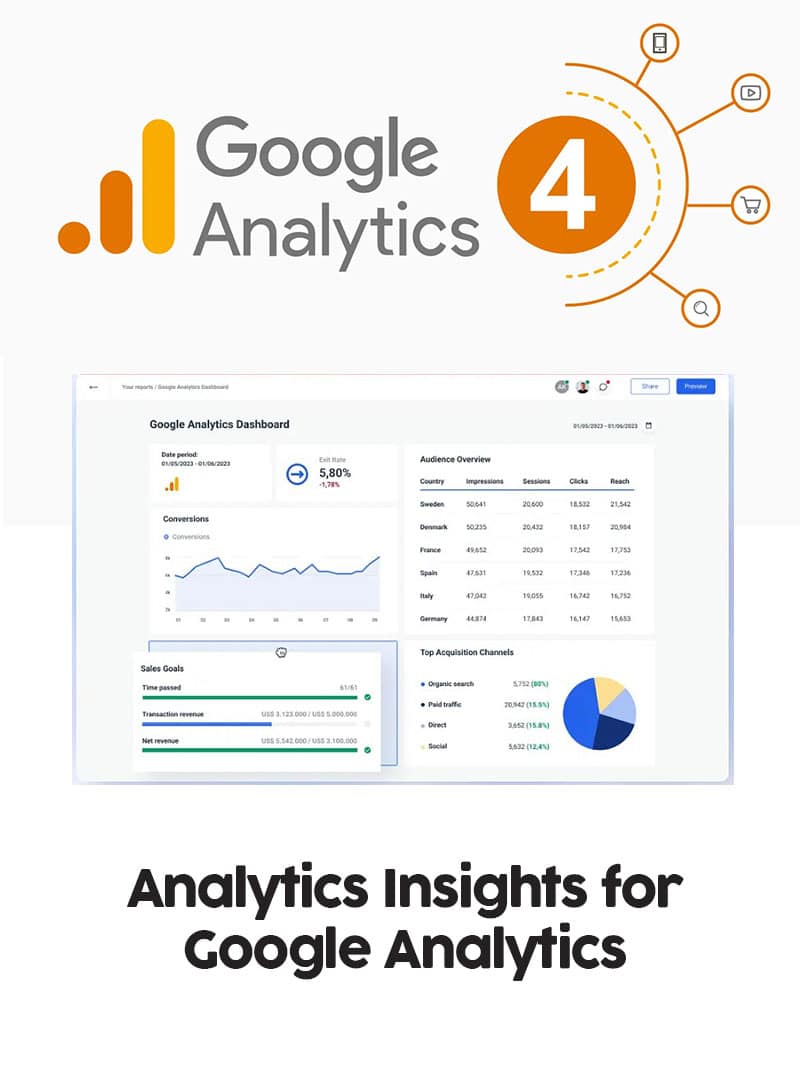

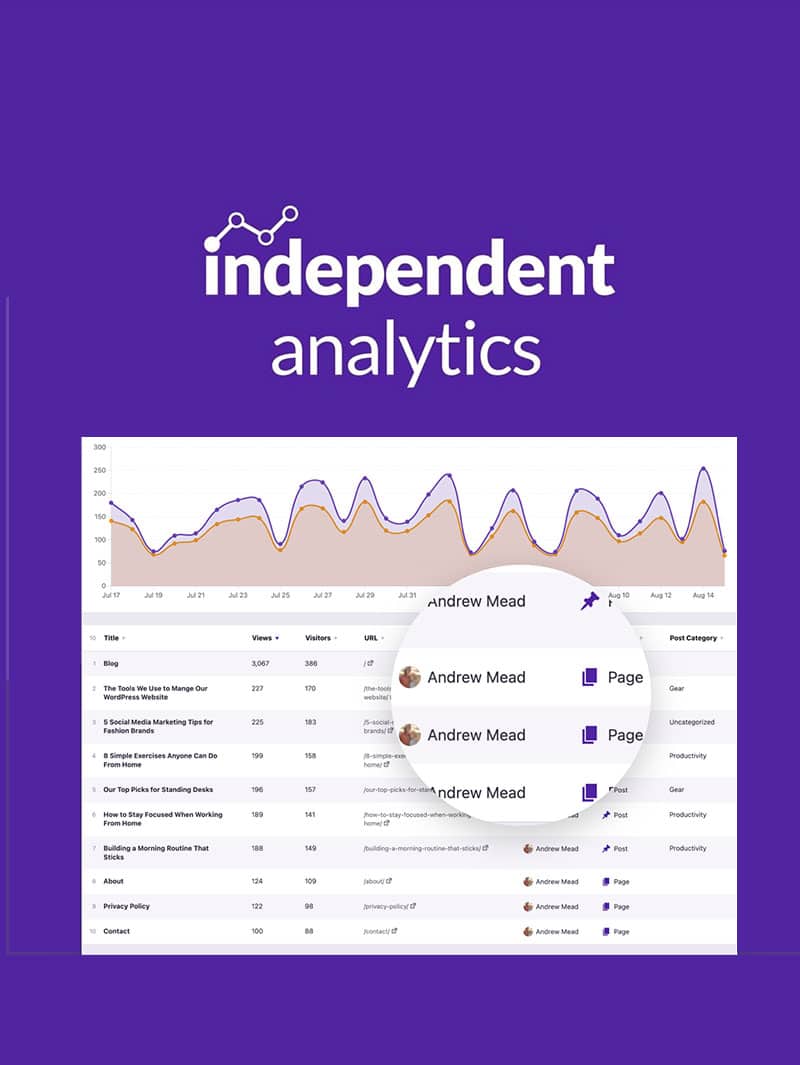

EN POPÜLER EKLENTİLER

Herkesin en beğendiği eklentiler burada. Seninki hangisi?

EN BEĞENİLEN KURUMSAL TEMALAR

Hem müşterilerimizin hem de bizim en beğendiğimiz kurumsal temalarda seçmeler aşağıda yer almaktadır. Sizin favori temanız hangisi?

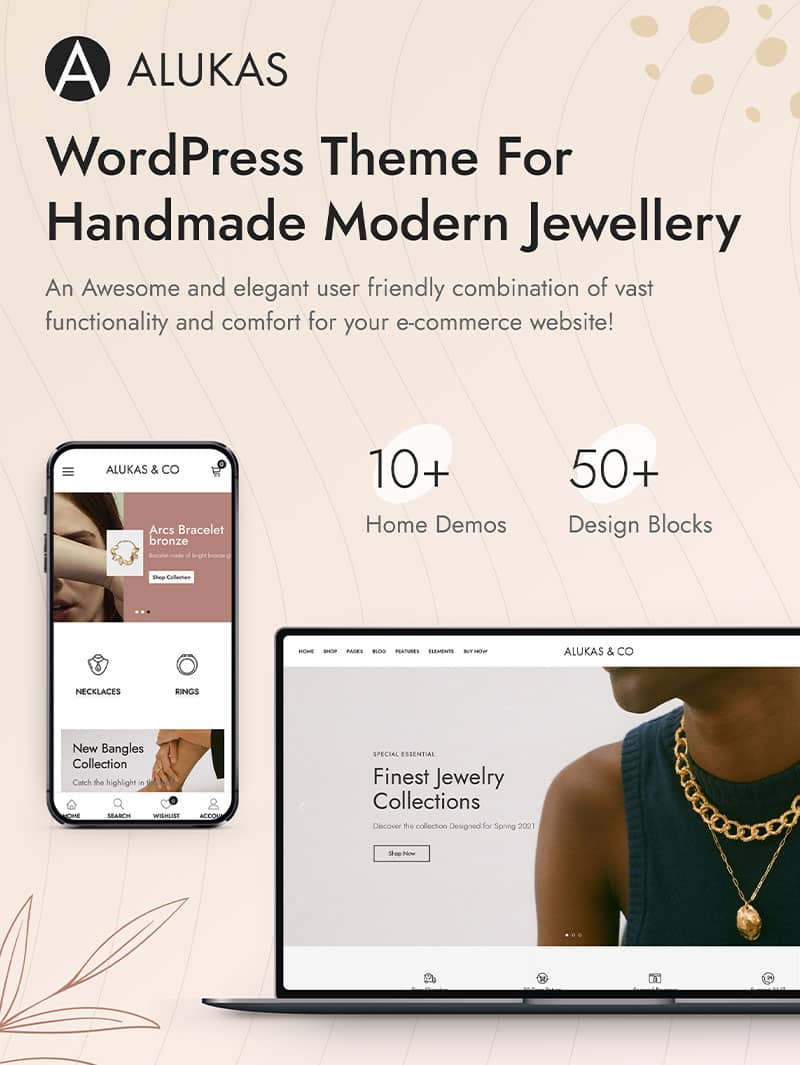

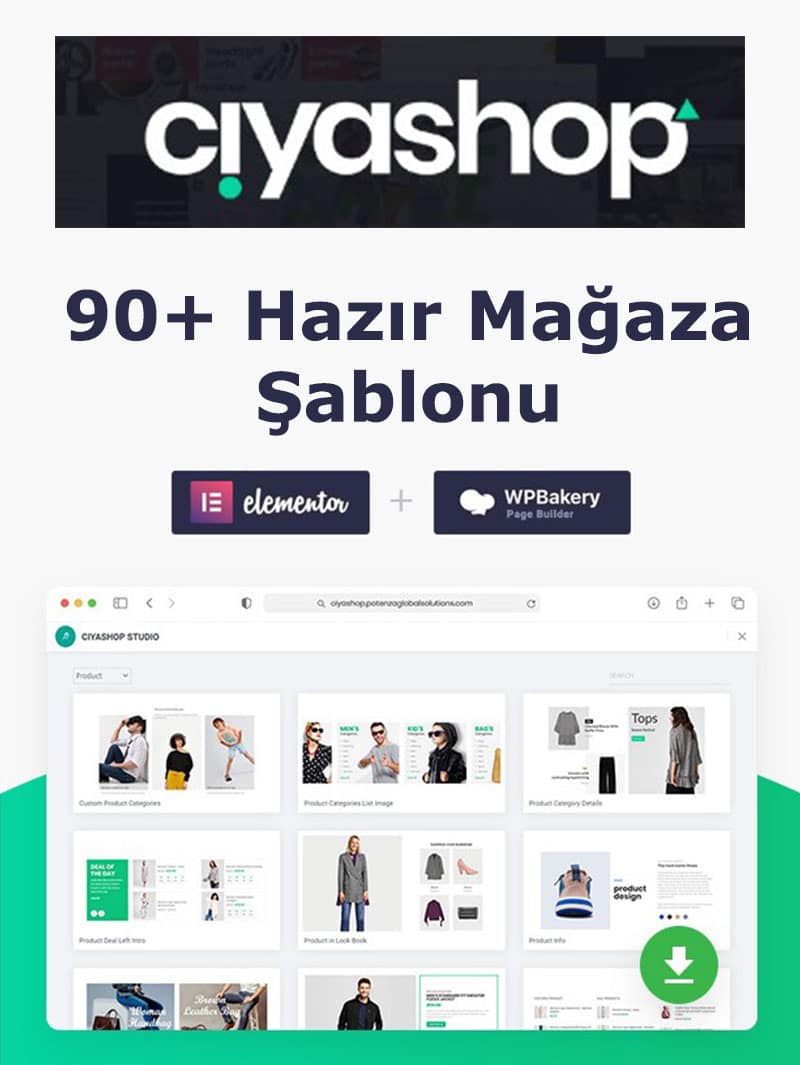

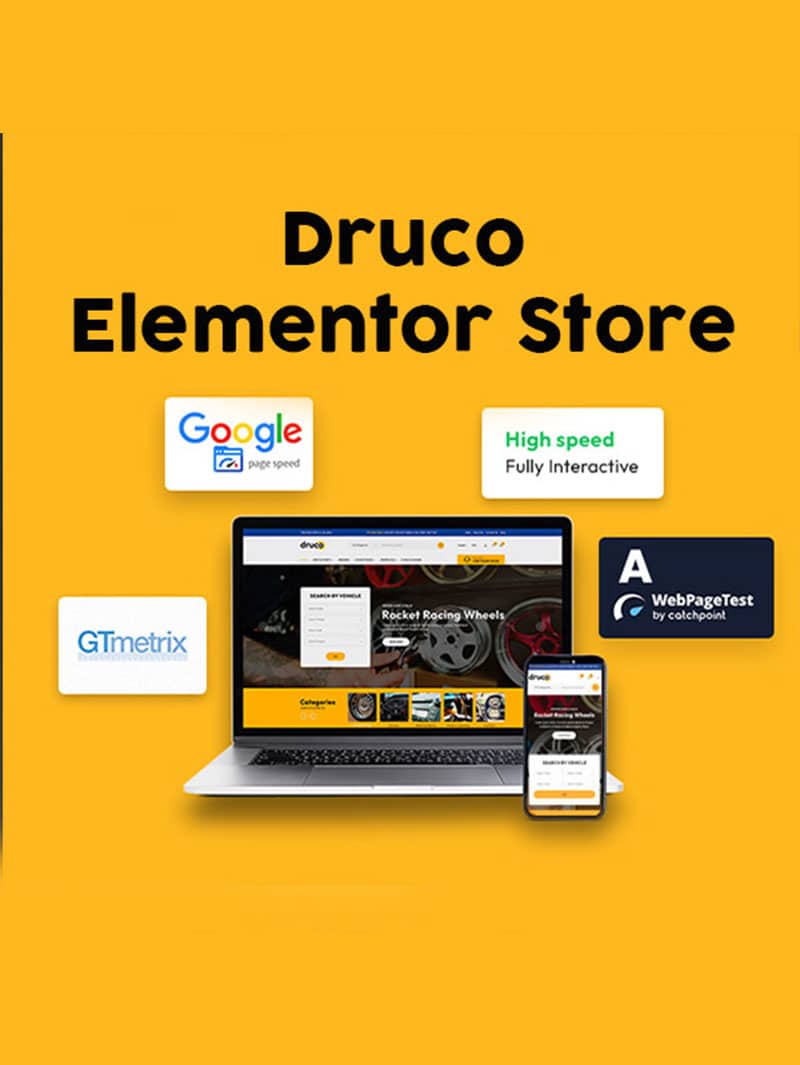

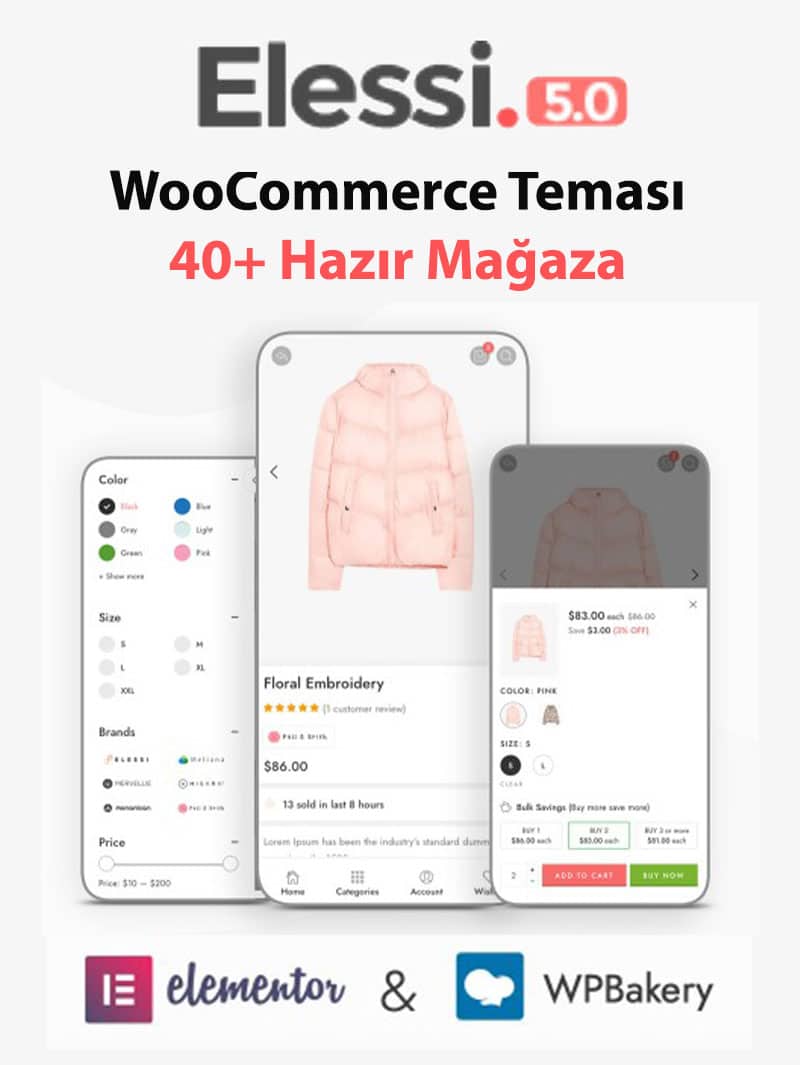

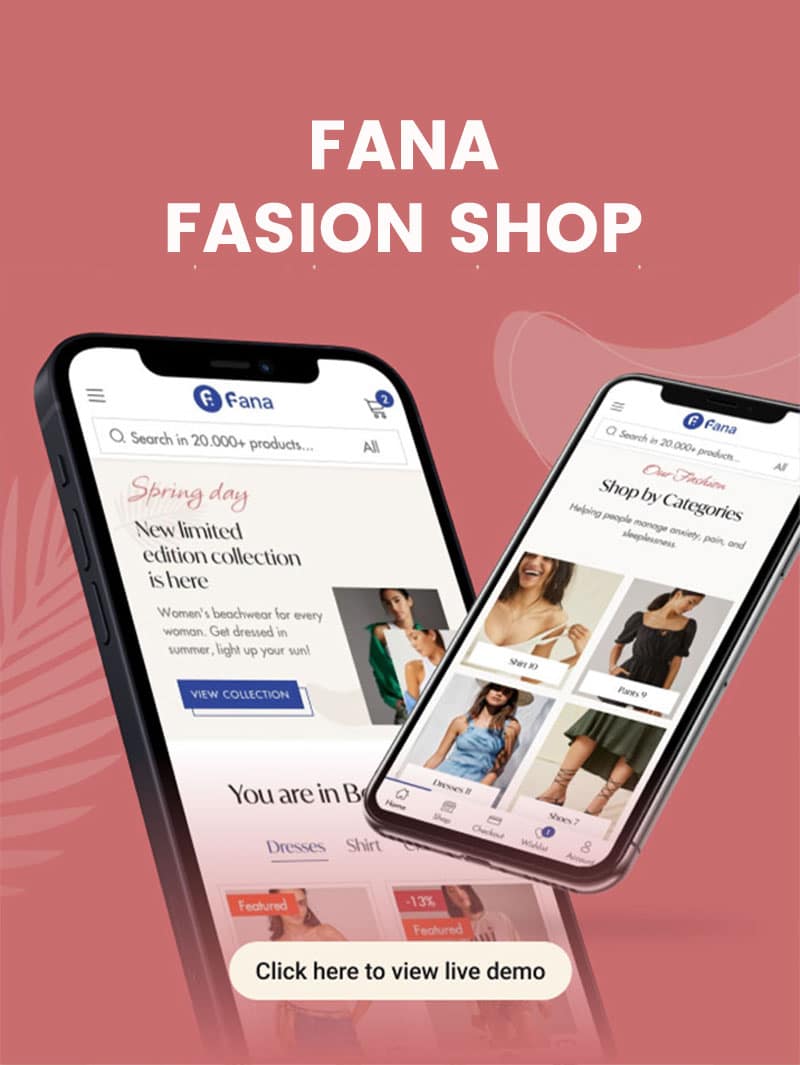

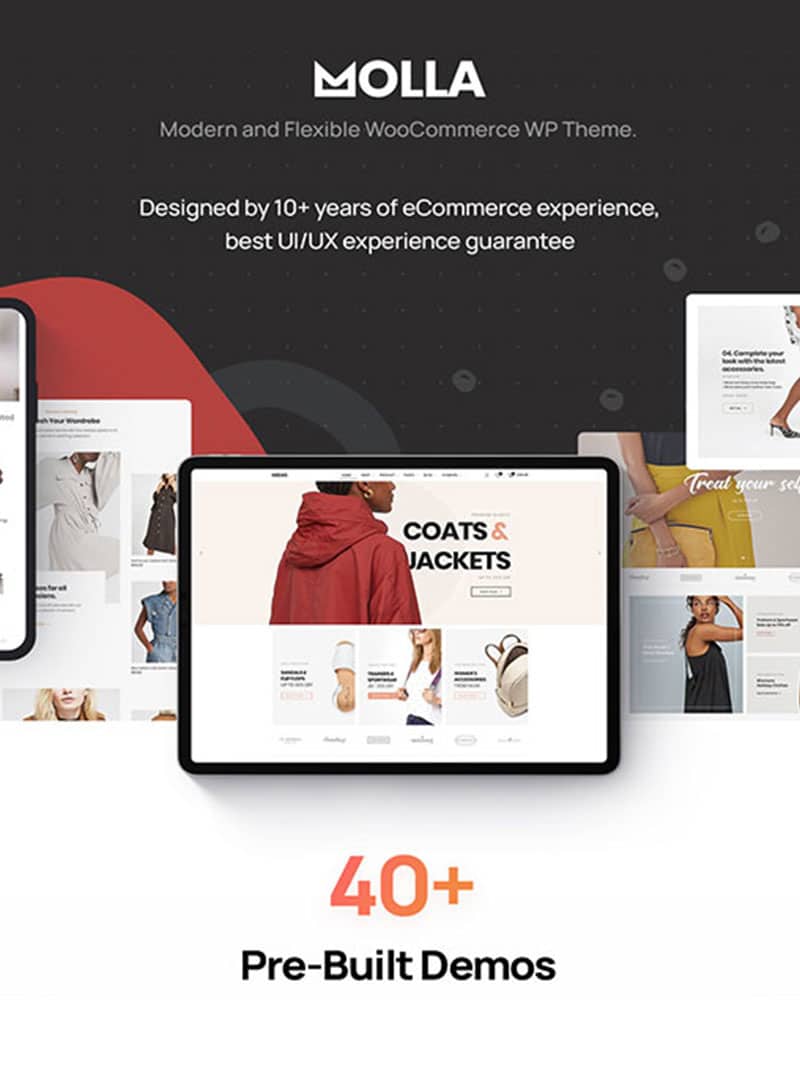

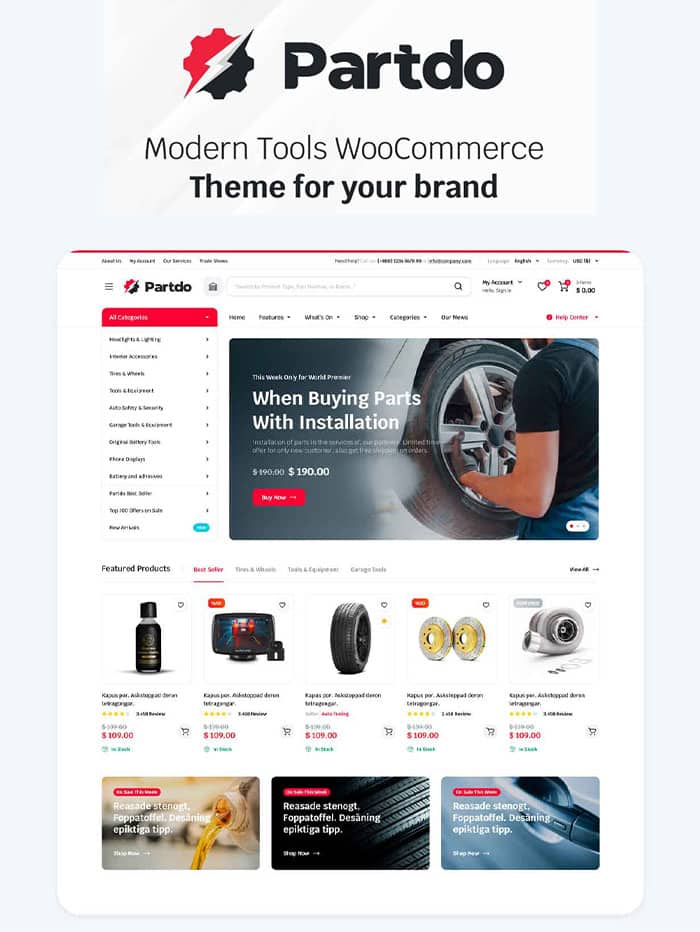

EN BEĞENİLEN E-TİCARET TEMALARI

Hem müşterilerimizin hem de bizim en beğendiğimiz WooCommerce temalarda seçmeler aşağıda yer almaktadır. Sizin favori temanız hangisi?

EN SON GELEN ÜRÜNLER

Ürün alımlarını sadece hoşuma giden, sizlere faydası olabilecek, projelerinizde işinizi görebilecek ürünlerden seçerek yapıyorum. Sadece olsun diye pek ürün aldığım olmuyor. O bakımdan buraya koymaya değer bulduğum ürünleri sizlerin de incelemesini tavsiye ederim.